Quest 8: Bedrocks of a Legacy: Build your Bitcoin Citadel

Table of contents

- OBJECTIVE: Read the Art of War by Sun Tzu

- Your Citadel’s needs

- OBJECTIVE: Write down your own Pleb Principles

- OBJECTIVE: Design your bitcoin wallets and the flow of your funds

- OBJECTIVE: Design the underlying private key setups of your wallets

So, you have done a bunch of things I told you but now things start to get more serious as you will see. Consider all previous chapters a primer compared to what you will do here because this quest requires not just your undivided attention and dedicated work but also your unique input and creativity.

You are now on a level of security where frankly, most Bitcoiners never get to. But don’t be complacent like LukeDashJr., the renowned Bitcoin Core developer who must be like a 1000 times more knowledgeable than you and I and he still lost his hard-earned bitcoin. This is a reminder for all of us that threats are very real.

You know, Bitcoin is still so early you can basically buy it on a 99% discount today. Being the most valuable “crypto”(hate the term) just means that it is a big fish in a little pond.

What am I getting at though?

The attacks we have experienced against Bitcoiners either in cyber- or meat-space are nowhere near what might come in the future. E.g. have you heard of Executive Order 6102? You’re right, most nation states will hate bitcoin just as they hated Gold as a store of value safe haven. The degree to which you must be ready cannot be overstated.

Hopefully open standards and open-source software keeps up with high security expectations but virtues like Responsibility, Humbleness and Persistent Learning cannot be replaced by code or machines.

Get too lazy and comfortable and lose your bitcoin. Get too proud and lose your bitcoin. Get too paranoid and lose your bitcoin.

Become virtuous and vigilant, and enjoy the fruits of freedom for you and your family, far into the future. The new legacies are just being brought to life. It starts small. It starts with individuals. It starts with you. The safe haven for you and for anyone you might share it with.

This is Your Bitcoin Citadel

Therefore, You must master Self Custody and develop your Bitcoin Pleb Philosophy to safeguard that legacy you started to build!

You must know that creating something is far more difficult than maintaining it. You are gonna be the linchpin to build and make your Citadel work. The first in line. This is a huge responsibility. But it is not unfeasible. Don’t get terrified from hard work, but then again, you made it so far so I should be getting down to business instead of sermons.

Think of your Citadel literally like your safe haven fortress-like city that has lines of defenses, soldiers, citizens and rules to abide by for all inhabitants.

You are the Captain of this Citadel

OBJECTIVE: Read the Art of War by Sun Tzu

- It is free and you will benefit from it tremendously, not to say that it is an afternoon read.

Learn a lesson about warcraft, stratagem and tactics because you are going to apply many of these principles building and maintaining your Bitcoin Citadel.

So let us get down to practical business: You have learned a thing or two about bitcoin and private key management so far. Therefore you can start to lay out the designs of your Citadel:

Your Citadel’s needs

-

Primary defense - Security:

- Avoid Single Points of Failure(SPoF) due to

- Human error, Loss, degradation, destruction - Acts of God

- Physical and cyber Attacks - Acts of People

- Protect against collusion

- Multifactor spending conditions mitigate single point of failure but introduce possible unauthorized spending behind your back

- You need a setup where you are absolutely necessary for spending

- Avoid Single Points of Failure(SPoF) due to

-

Secondary defense: Privacy

- Spending privately

- Maintain discretion with regards to your exact Citadel parameters like amounts, locations, holders…

- Reactionary defense: In an optimal scenario you set up your spending conditions so that you can undo an unauthorized spending. Although solutions exist to this problem today, they are not very effective and introduce more than acceptable potential footguns in my opinion. Solutions to this problem with acceptable trade-offs are still in the making in bitcoin

-

Handle special cases like

- Inheritance

- Relocation of keys/residence

- Travel - Leaving your home

- …? People live under different conditions. Think about potential events with realistic security and privacy concerns.

This all could seem overwhelming to tackle at this point. Don’t worry, with the help of the lessons learned so far and some mental framework for inspiration, you can do this.

There can be no Captain without principles of his/her own. So let’s start at that.

OBJECTIVE: Write down your own Pleb Principles

- Contemplate on your Principles as a Bitcoin Pleb. Compose a draft of your thoughts of what that means to you in your Keepass database

- Read the Pleb Principles template for inspiration

- Refine your Principles from the inspiration

- Share your thoughts and experience if you feel like it!

Documenting everything in Keepass creates a true metadata quarters in your Citadel encompassing many things you would want to revisit from time to time alone or with trustees and pass it on if anything happened to you. While written text cannot convey Principles perfectly(it is acted out), the clarity it brings can be beneficial to you and others as well.

From the Principles you wrote down, you can now get down to the nitty-gritty practical design of your Citadel.

OBJECTIVE: Design your bitcoin wallets and the flow of your funds

- 💡 Learn a deeper lesson about wallet types and the Game Theory of Self-Custody

- List your fiat revenue sources

- Some people have multiple fiat accounts just because many times your bank censors “suspicious” transactions when you are buying NoKYC bitcoin

- List your fiat wallets

- Bank accounts

- Accounts with payment providers(Venmo, Paypal, Strike, CashApp, Revolut, Wise…)

- List your Bitcoin revenue sources, if any

- Pleb Mining

- V4V

- Doing some work for sats

- List the bitcoin wallets for your different purposes. Examples:

- Wallet(s) for NoKYC Bitcoin purchase, e.g. Bisq wallet

- NoKYC Cold wallet(s)

- For safe HODL

- KYC wallet(s), if you already doxxed yourself

- Always coinjoin these and never merge the KYC sats with the NoKYC sats.

- “Checking account” Warm wallet(s)

- For easier access to a medium amount of sats if need be

- Spending “pocket money” wallet(s). Cases:

- For NoKYC purchases

- For Value for Value purposes

- For Donations

- Inheritance wallet(s)

- For your loved ones. Part of your last will and testament practically

- Coinjoin hot wallet(s). If you know what you’re doing.

- Decoy wallets with enough sats to satisfy an attacker. I’d recommend above 500 USD. Your call

- Get a simplistic, open source, offline flowchart diagramming or mind mapping tool. My go-to is draw.io desktop

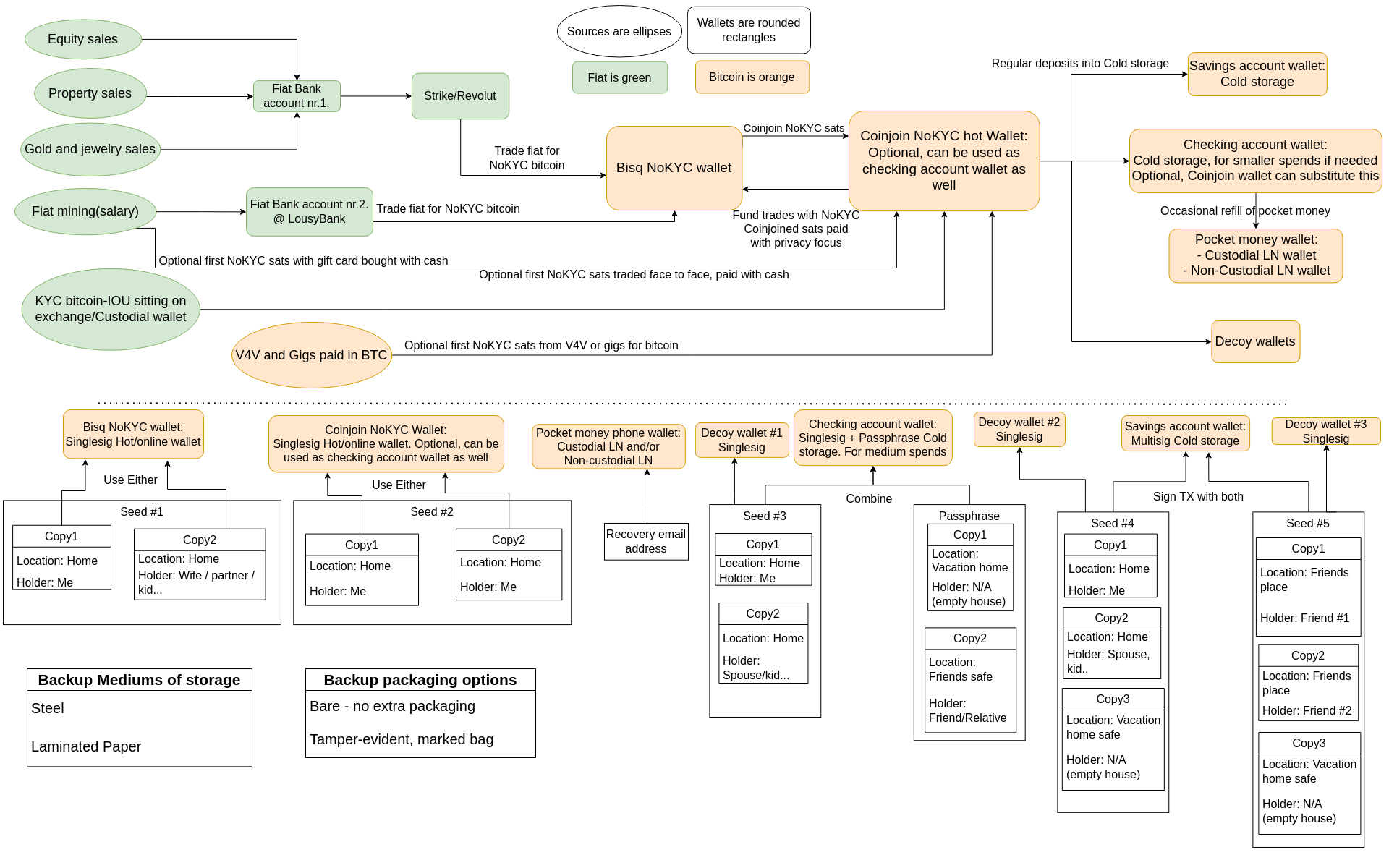

- Model the flow of your funds. See example(click to enlarge):

- The sources and wallets are the nodes

- The arrows show the funds flowing to your wallets or to the external world as spendings.

- You can use colors and shapes to distinguish between fiat and bitcoin wallets

- Write the purpose of the typical transactions on the arrows

- Hint: Accessing your cold storage wallet should be very rare. So design the flow to be able to spend from other wallets mostly.

- Hint: Some people coinjoin coins first regardless of KYC or NoKYC. Helps to ensure that no one, not even your P2P trading partner can track your funds.

You can see your wallet setup and flow of your funds layed out in front of you. Now you have to make other important choices. Namely, each wallet has to be realized by individual private key and passphrase setups. The more funds it holds the more security it needs.

OBJECTIVE: Design the underlying private key setups of your wallets

- List all wallets underneath your flow diagram

- Design the spending strategy of each wallet i.e. single sig, single sig + passphrase, multisig. Hot wallet or watch-only airgapped wallets for cold storage

- Be realistic. You could take a gradual approach and design a simple setup first then upgrade as you get more confident

- Design the number of copies of each required piece of information

- Determine the storage medium, package, location and holder of each copy

- Think about the security of those places and the people you want to trust. Guns and safes are good. Secret places can be compromised more easily

- Start your own threat model document

- Prioritize possible threats you want to defend against

- Devise a reaction-scenario

- Refine your Citadel setup if needed

- Look at it with your loved ones. Talk about it and refine it once again.

- Go over the design choices, tradeoffs and possible vulnerabilities with them

- Go over the inheritance procedure. Write it down or model it in the diagram or both. You could add wallets for this purpose specifically if you want

- Cover any other important cases like traveling and vacation, possible relocation of residence…

- Export your diagrams in editable and view-only(pdf) format and save them in KeePass

- Delete the original unencrypted files

- Create new records in your Keepass database for each wallet and save important data

- Wallet encryption password

- Wallet fingerprint and any notes

- Add attachment: Sparrow wallet export which contains your labels as well

- Add any other attributes for easy overview, edit and copy, in the

“Additional attributes”section: Storage mediums, packages, locations, holders etc. by private key copies

- Save your Security-Privacy best practices in KeePass

- Use tags and folders in KeePass for easier search

- Define when and how you will maintain and audit your Citadel

- Check on trustees

- Check secret places if any

- Check wallet balances

- You can choose to check on them regularly by having them open in watch-only mode Sparrow. The tradeoff is that your Xpubs could be leaked by your networked computer. Always use strong encryption passwords for wallet files

- Occasional Privacy sanitations

- Create instructions for trustees

- Cover the cases described above

- You can implement a protocol with them about what to do in certain situations.

- How you would normally ask for the info they hold and what to do if you seem to be under duress or anything is off with you

- Meet your trustees and have a conversation. Share the instructions with them. Emphasize that they are no “single points of failure”. They hold important information but they are not holding your life savings. It is just additional insurance

- Develop drills for your heirs and trustees to learn to use your stack and understand bitcoin. Get creative. Share them on nostr!

- Optional: Lay out a plan for upgrade in the future

- What upsides the upgrade will bring

- When and how you will upgrade it

- Save all your work in the Keepass Database. Copy it to the backup microSD cards

- Bitcoin is still young. Many Self Custody solutions may come in 5-10 years that will make you reconsider your design. Count on this.

Great! This is what I call Proof of Work!

Now you can consider yourself a real Bitcoin Pleb!

Share your experience with this journey and of course…keep learning because this is just the beginning.

There are so many interesting and useful rabbit holes to explore in the land of bitcoin self custody and freedom-tech. The amount of time spent on these topics will get you abundant returns in many areas of life.